Get extended deadline for the tax return for 2024

When the deadline for submitting the tax return approaches, you may need more time. Here is a guide on how to apply for an extension.

How to apply for extended deadline for the tax return

If you prefer to get straight to the point without reading the entire article, you can find the application form here:

- For non-business operators: Application for extension.

- For business operators: Application for extension.

Deadline for submission of the tax return for 2024

- Non-business operators: The deadline is Wednesday April 30, 2025.

- Business operators: The deadline is actually May 31, 2025, but since the deadline falls on a Saturday, the deadline is postponed to Monday June 2, 2025.

What applies to the tax return to be submitted spring 2025?

Spring 2025 you must ensure that the Tax Authority has correct information about your income and deductions for the income year 2024, and your assets and debt at the turn of the year 2024/2025.

Is it necessary to submit the tax return?

If the pre-filled tax return you received from the Tax Authority is completely correct and complete, you do not need to do anything. It is nevertheless wise to check that the information is correct.

If you had cryptocurrency in 2024, or other income and assets, that are not included, you must change the tax return and submit it at skatteetaten.no.

If you had deductions and debt that are not included, you should change the tax return.

How to apply for extension of the deadline for submission of the tax return

If you need more time, you can easily request a one-month extension, which is automatically granted. Here are the steps to apply:

1. Choose the right form: Use the links below to open the form for your situation.

- For non-business operators: Application for extension.

- For business operators: Application for extension.

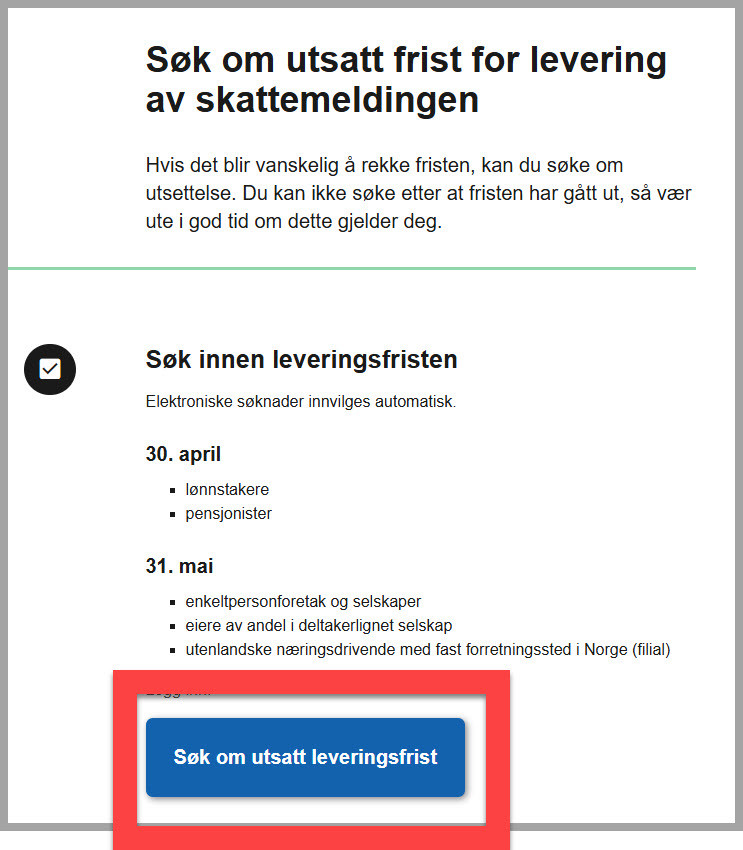

2. Click on the blue button: Apply for extended submission deadline

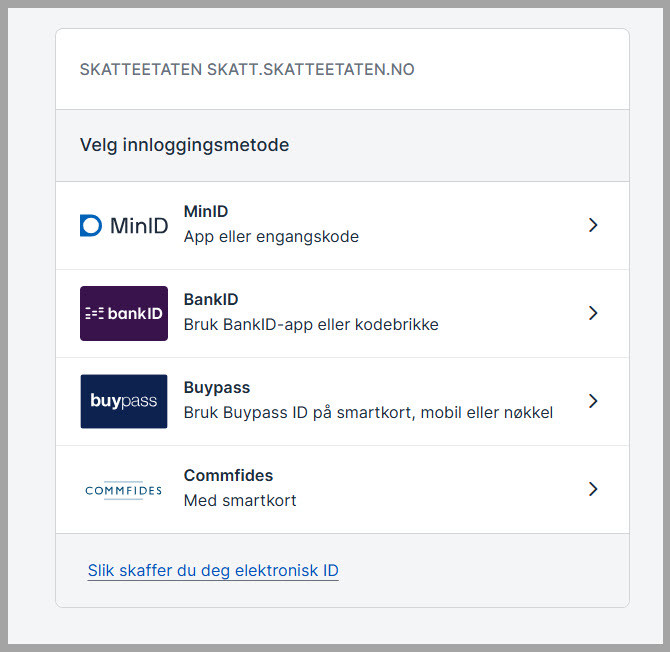

3. Log in to skatteetaten.no

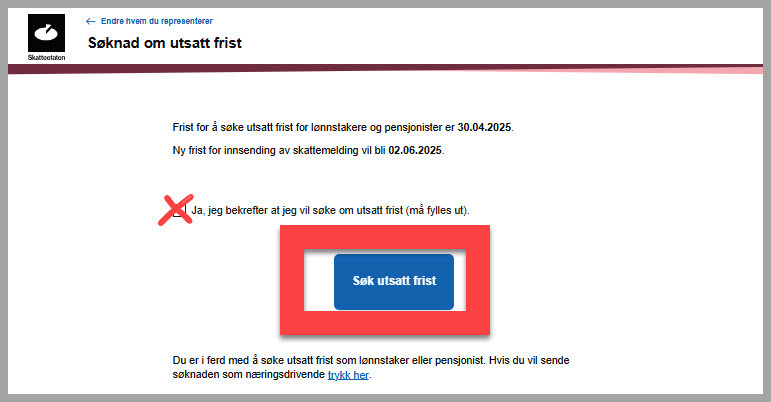

4. Check the box and click on the blue button “Apply for extended deadline”

Legal sources about deadlines for the tax return:

- Tax Adm inistration Regulation § 8-2-3 Submission deadline for tax return

- Tax Administration Regulation § 8-2-5 Application for extended submission deadline

- Tax Administration Act § 5-5 Deadline calculation

- Courts Act § 149 About deadlines ending on a Saturday, public holiday etc.

- Tax Administration Act § 8-2 Tax return for wealth and income tax etc.

- Tax Administration Act § 8-16 Regulations etc.